Without context, a comparative point, knowledge of its previous cash balance, and an understanding of industry operating demands, knowing how much cash on hand a company has yields limited value. As noted above, you can find information about assets, liabilities, and shareholder equity on a company’s balance sheet. The assets should always equal the liabilities and shareholder equity.

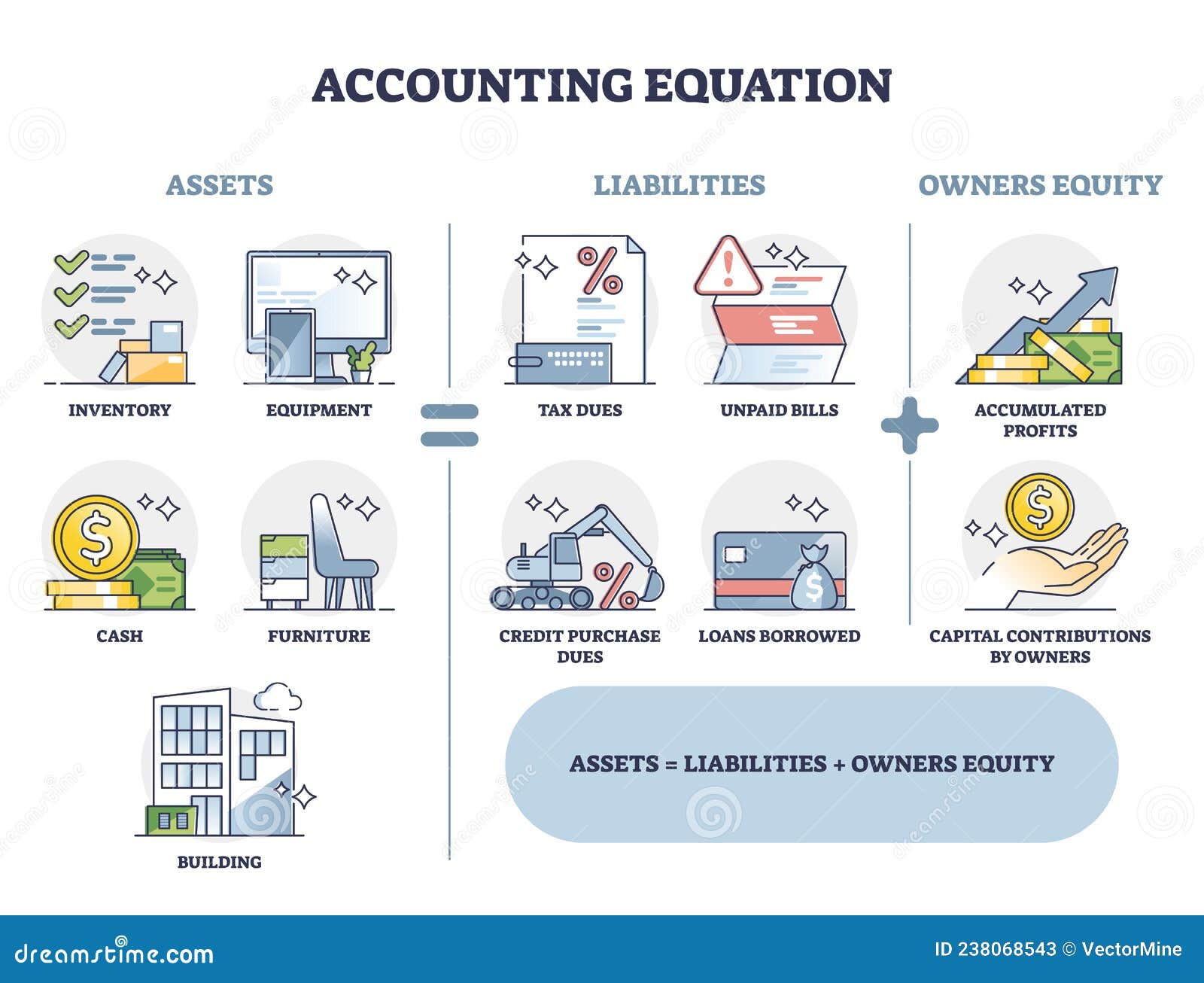

The accounting equation

- Accounting equation describes that the total value of assets of a business entity is always equal to its liabilities plus owner’s equity.

- Net Assets is the term used to describe Assets minus Liabilities.

- Since they own the company, this amount is intuitively based on the accounting equation—whatever assets are left over after the liabilities have been accounted for must be owned by the owners, by equity.

- At this time, there is external equity or liability in Sam Enterprise.

- The accounting equation is also called the basic accounting equation or the balance sheet equation.

The income statement is also referred to as the profit and loss statement, P&L, statement of income, and the statement of operations. The income statement reports the revenues, gains, expenses, losses, net income and other totals for the period of time shown how to improve operations management behind the scenes in the heading of the statement. If a company’s stock is publicly traded, earnings per share must appear on the face of the income statement. The balance sheet is also known as the statement of financial position and it reflects the accounting equation.

Rearranging the Accounting Equation

While investors and stakeholders may use a balance sheet to predict future performance, past performance is no guarantee of future results. Using Apple’s 2023 earnings report, we can find all the information we need for the accounting equation. This transaction brings cash into the business and also creates a new liability called bank loan.

Do you already work with a financial advisor?

Brian is a member of the HBX Course Delivery Team and is currently working to design a Finance course for the HBX platform. He is a veteran of the United States submarine force and has a background in the insurance industry. After enrolling in a program, you may request a withdrawal with refund (minus a $100 nonrefundable enrollment fee) up until 24 hours after the start of your program.

What Are the Five Sections of a Balance Sheet?

If you’re still unsure why the accounting equation just has to balance, the following example shows how the accounting equation remains in balance even after the effects of several transactions are accounted for. The accounting equation is a concise expression of the complex, expanded, and multi-item display of a balance sheet. Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

Once you get the loan, this is how your accounting equation changes. Cash (asset) will reduce by $10 due to Anushka using the cash belonging to the business to pay for her own personal expense. As this is not really an expense of the business, Anushka is effectively being paid amounts owed to her as the owner of the business (drawings).

This includes expense reports, cash flow and salary and company investments. Although the balance sheet is an invaluable piece of information for investors and analysts, there are some drawbacks. For this reason, a balance alone may not paint the full picture of a company’s financial health. Below liabilities on the balance sheet is equity, or the amount owed to the owners of the company. Since they own the company, this amount is intuitively based on the accounting equation—whatever assets are left over after the liabilities have been accounted for must be owned by the owners, by equity. These are listed at the bottom of the balance sheet because the owners are paid back after all liabilities have been paid.

In both cases, the external party wants to assess the financial health of a company, the creditworthiness of the business, and whether the company will be able to repay its short-term debts. Investors can get a sense of a company’s financial well-being by using a number of ratios that can be derived from a balance sheet, including the debt-to-equity ratio and the acid-test ratio, along with many others. The income statement and statement of cash flows also provide valuable context for assessing a company’s finances, as do any notes or addenda in an earnings report that might refer back to the balance sheet.

At this time, there is external equity or liability in Sam Enterprise. The only equity is Sam’s capital (i.e., owner’s equity amounting to $100,000). If we rearrange the Accounting Equation, Equity is equal to Assets minus Liabilities. Net Assets is the term used to describe Assets minus Liabilities. Regardless of how the accounting equation is represented, it is important to remember that the equation must always balance. The accounting equation is fundamental to the double-entry bookkeeping practice.