Sharon worked you from the app concerns and write to us exactly what i requisite. Given that refinance procedure continued, she is usually in touch with united states and inform us in which the application was in the procedure. Sharon made the process all the time painless.

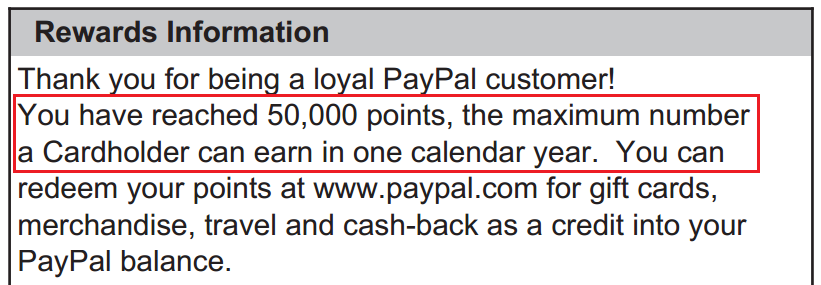

6.529% APR*

*Annual percentage rate mode Annual percentage rate. The costs stated assume the reason for the loan are sometimes a re-finance otherwise acquisition of an initial house, with a good 20% otherwise https://paydayloanalabama.com/rosa/ better deposit, an increase secure ages of forty five weeks, a debtor with a credit score away from 640 or better and you can the loan matches the newest qualifying criteria on the Federal Home loan Bank’s (FHLB) Financial Get System. Prices subject to change without warning and may be changed provided your unique problem.

Determine your month-to-month homeloan payment to match your finances making use of the costs and you will words more than given that a helpful publication recalling the speed you are able to qualify for would-be additional based products for example label plus credit score.

Conserve to possess an advance payment

A down-payment is the finance you implement to your get of your house, but is maybe not as part of the amount borrowed.

The level of advance payment needed may vary for various home loan designs. Antique mortgage loans fundamentally need at least 5% off.

Look at the Credit history

Your credit rating is actually a number between 3 hundred and you will 850 one depends upon the commission background, number owed, period of credit score, and you will types of borrowing from the bank made use of. Ideal credit reports and better score ensure it is simpler and you may lesser so you’re able to acquire.

If you find yourself worried that you may maybe not qualify for good old-fashioned loan according to your credit score, your lender can get suggest a different sort of financial like a when you look at the-domestic selection.

Can i sign up for a home loan prior to I’ve found property buying?

Sure, signing up to score pre-recognized getting home financing before you could see a house is but one of the finest activities to do.

We shall gather your financial suggestions, opinion your borrowing and you will pre-agree your. You need their pre-acceptance page to assure real estate agents and sellers that you will be a great licensed customer, which may give you more weight to almost any provide to find you will be making.

What is the difference between Annual percentage rate and you may rate of interest?

The new Government Details inside the Lending law makes it necessary that most of the financial institutions divulge Apr after they advertise an increase. The brand new Apr is made to show the actual price of funding and you may includes closing costs regarding mortgage formula. Yet not, not all fees come and you will loan providers can understand hence charges it is. Fees such as assessment and you will term performs aren’t needed to be as part of the Annual percentage rate computation, nevertheless might still be required to pay them. This type of charges, also the interest rate influence the fresh projected cost of funding along side full-term of the loan.

Annual percentage rate is an effectual interest, however the genuine interest rate. The true interest, along with term while the count your borrower is exactly what is utilized whenever figuring your repayments.

Exactly what are escrows? In the morning I expected to become all of them in my own payment per month?

Escrows try monies booked getting spending the taxation and you will homeowner’s insurance. Some people choose spend such by themselves and keep maintaining its fee no more than possible, and others will pay them within its home loan payment.

You have to escrow if you don’t put down 20% when purchasing otherwise provides 20% security on your property whenever refinancing.

Would I want to find my very own appraiser?

Zero, we will order the fresh new appraisal for your requirements. We utilize a great ’round robin’ out of regional, registered appraisers that will be used to our very own business.